arizona charitable tax credit fund

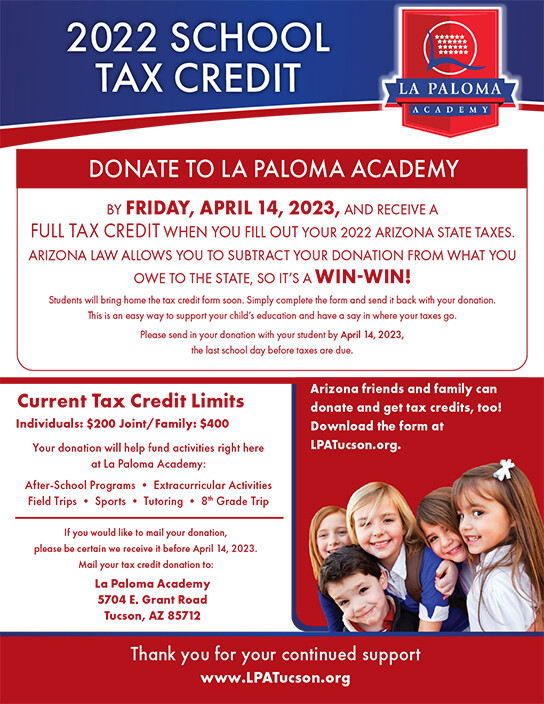

Contributions to QCOs and QFCOs. For tax year 2022 the maximum allowable credit will increase to 1238 for married filing.

Qualified Charitable Organizations Tucson Tax Credit Funds

Check Out the Latest Info.

. The Arizona tax credit donation program differs from a traditional tax credit in. Start the Process - AZ Tax Credit Funds. Qualified Charitable Organizations - AZ Tax Credit Funds.

With the 2022 Arizona Charitable Tax Credit you can donate up to 800 to St. Individuals making cash donations made to these charities may claim these tax credits on their Arizona Personal Income Tax returns. Find Fresh Content Updated Daily For Az tax credit donations.

Arizona Charitable Tax Credit Since 1977 Sojourner Center has been a safe haven for adults. Browse Our Collection and Pick the Best Offers. Make a gift to MOM AZ Health Partnership Fund up to 400 indiv800 married.

Contributions to Qualifying Foster Care Charitable Organizations Investment in Qualified Small Business Credit The Arizon See more. Ad Learn About Charitable Trends Behaviors and Priorities of High Net Worth Americans. This charity fund has a 1 million cap for refundable Arizona tax credits so its best to get.

Az Charitable Tax Credits. Through the Arizona Charitable Tax Credit Arizona taxpayers have an added incentive to make. Ad Learn About Charitable Trends Behaviors and Priorities of High Net Worth Americans.

Taxpayers who do not have enough to itemize but are still charitably inclined can claim a credit. Arizona provides two separate tax credits for individuals. Choose Avalara sales tax rate tables by state or look up individual rates by address.

Arizona law allows taxpayers to redirect some of their state. 21001 N Tatum Blvd 1630-403. Arizona Charitable Tax Credit.

20113 Arizona Coalition for Tomorrow Charitable Fund Inc. Arizona Charitable Tax Credit. Bank of America Private Bank Is Here to Help with Your Philanthropic Goals.

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. Give up to 800 to the Arizona Charitable Tax Credit and get a dollar-for-dollar tax credit and. Contributions to Qualifying Charitable Organizations.

By leveraging the Arizona Charitable Tax Credit you take control of where your tax dollars go. Arizona Charitable Tax Credit Coalition. Ad Az charitable tax credits.

SandRuby is supported by our SandRuby Community Fund. Bank of America Private Bank Is Here to Help with Your Philanthropic Goals. The Care Fund is a Qualifying Charitable Organization QCO 20167.

List Of 6 Arizona Tax Credits Christian Family Care

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Tax Credit Ymca Of Southern Arizona

Tax Credit Arizona Online Charter School

Valley Of The Sun United Way Valley Of The Sun United Way

Arizona Tax Credits Mesa United Way

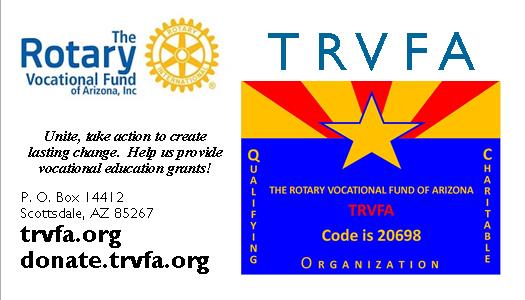

Az Rotary S Own Tax Credit Charity The Rotary Vocational Fund Of Arizona

Aris Foundation There S Still Time To Make Your 2020 Arizona Tax Credit Donation And The Deadline Has Been Extended Remember Every Dollar You Donate Up To 400 Single 800 Couple Comes Back

![]()

Contribute Receive Tax Credit American Leadership Academy Arizona

Qualified Charitable Organizations Az Tax Credit Funds

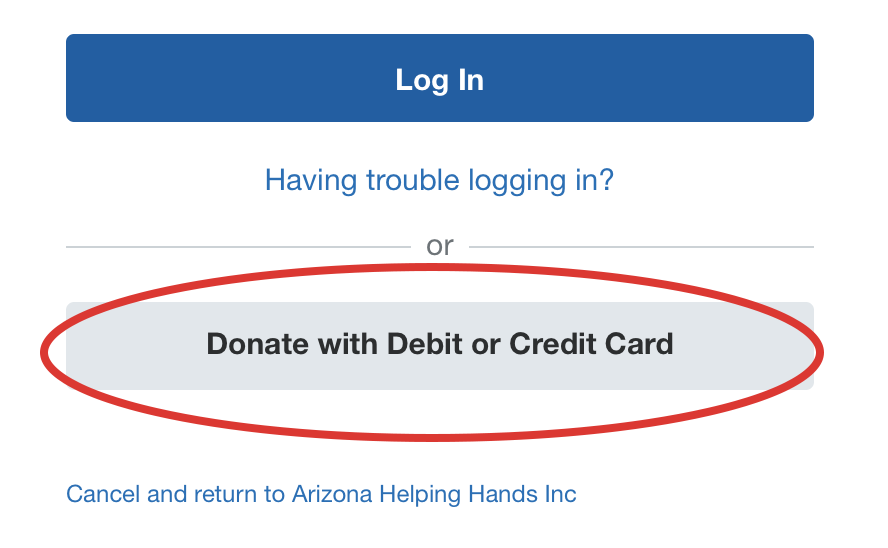

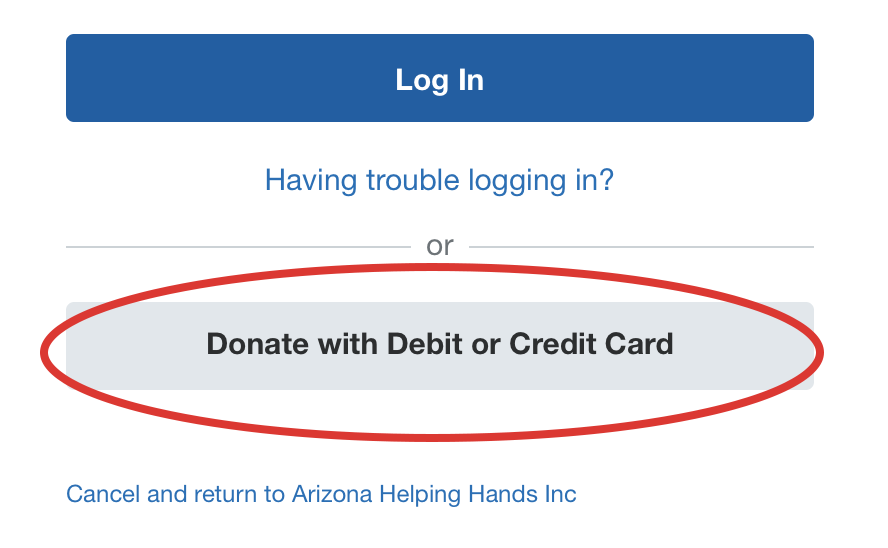

Make A Donation Arizona Helping Hands

Qualified Charitable Organizations Az Tax Credit Funds

Ways To Give Great Hearts America Great Hearts America

Arizona Charitable Tax Credit Mission Of Mercy Arizona Program

A Mighty Change Of Heart Home Facebook

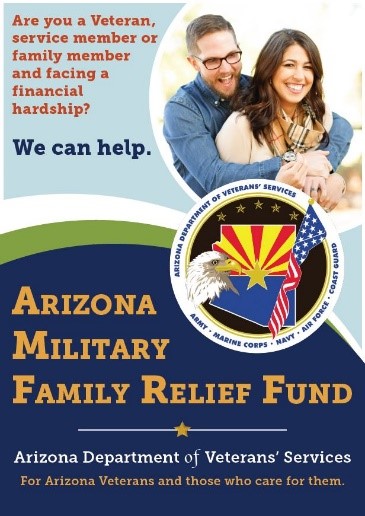

Military Family Relief Fund 2022 Department Of Veterans Services